The Beginner’s Guide to Stock Market Investing

The Beginners Guide to Stock Market Investingin the stock market can seem intimidating at first, but with the right knowledge and strategies, anyone can start building wealth over time. This guide will break down the essentials of stock market investing for beginners and help you make informed decisions.

1. What is the Stock Market?

The stock market is a collection of markets and exchanges where buying, selling, and issuance of shares of publicly-held companies happen. Companies list their shares on stock exchanges, and investors buy and sell those shares. The value of a company’s stock is determined by the market, which reflects investor sentiment, company performance, and other economic factors The Beginners Guide to Stock Market Investing.

2. Key Concepts To Know The Beginners Guide to Stock Market Investing

-

Stock: A share or ownership in a company. When you buy a stock, you own a small part of that company.

-

Stock Exchange: The platform where stocks are bought and sold (e.g., NYSE, NASDAQ).

-

Bonds: Debt securities issued by companies or governments to raise capital. Investors who buy bonds are essentially lending money and receiving interest in return.

-

Index Funds/ETFs (Exchange-Traded Funds): These funds pool money from many investors to invest in a collection of stocks or bonds, offering diversification and lower risk.

-

Dividends: Payments made by a company to shareholders out of its profits. Not all stocks pay dividends, but they can provide regular income.

3. How to Invest in Stocks

Step 1: Open a Brokerage Account

A brokerage account is necessary to buy and sell stocks. There are two main types:

- Full-service brokers: These provide investment advice and manage your portfolio for you, but they charge higher fees.

- Discount brokers: These allow you to buy and sell investments on your own and tend to have lower fees (examples: Robinhood, Fidelity, Charles Schwab).

Step 2: Fund Your Account For The Beginners Guide to Stock Market Investing

Once your brokerage account is open, you’ll need to deposit money to start investing. You can fund the account with a bank transfer or check, depending on the broker.

Step 3: Start Researching Stocks

Before purchasing, research companies you’re interested in. Look at their financial health, earnings reports, growth potential, and industry outlook. Some useful metrics to understand include:

- Price-to-Earnings (P/E) ratio

- Earnings Per Share (EPS)

- Dividend Yield

- Debt-to-Equity ratio

Step 4: Buy Your First Stock

Once you’ve decided on a stock, you can place an order through your brokerage account. There are different types of orders:

- Market Order: A request to buy or sell immediately at the current market price.

- Limit Order: A request to buy or sell only at a specific price or better.

Step 5: Monitor Your Investments

After buying stocks, it’s important to track their performance regularly. However, don’t panic if stock prices fluctuate—market volatility is natural. Keep a long-term perspective and avoid reacting to short-term market movements.

For More Visit Here

Follow On Instragram

4. Types of Stock Investments In The Beginners Guide to Stock Market Investing

-

Growth Stocks: Stocks of companies that are expected to grow at an above-average rate compared to other companies in the market. These stocks tend to reinvest profits back into the company rather than paying dividends.

-

Value Stocks: Stocks of companies that appear undervalued based on fundamental analysis. These stocks typically pay dividends and may not grow as quickly as growth stocks but are considered more stable.

-

Dividend Stocks: Stocks from companies that pay out regular dividends. These can provide a steady income stream in addition to capital appreciation.

5. Building a Portfolio

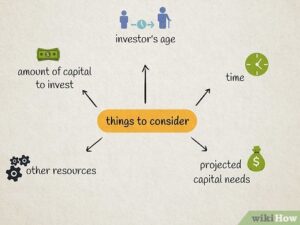

A stock portfolio is a collection of investments. A well-diversified portfolio can help reduce risk by spreading investments across different sectors, industries, and asset types (stocks, bonds, etc.) for The Beginners Guide to Stock Market Investing.

-

Diversification: Don’t put all your money into one stock or sector. By spreading your investments, you reduce the risk of losing everything if one investment goes bad.

-

Risk Tolerance: Determine how much risk you’re willing to take. Stocks can be volatile, and your ability to withstand market ups and downs will help guide your investment strategy The Beginners Guide to Stock Market Investing.

-

Asset Allocation: Decide how much of your money to allocate to different asset types (e.g., stocks, bonds, real estate). A common approach is to invest in a mix of stocks (for growth) and bonds (for stability).

6. Common Investing Strategies For The Beginners Guide to Stock Market Investing

-

Buy and Hold: This strategy involves buying stocks with the intention of holding them for an extended period, regardless of market fluctuations. It’s a long-term investment strategy.

-

Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money into a particular stock or fund regularly, regardless of its price. Over time, this reduces the impact of volatility.

-

Value Investing: This strategy, popularized by Warren Buffett, involves finding stocks that are undervalued by the market and buying them for long-term growth.

-

Growth Investing: This strategy focuses on investing in companies that have the potential for high growth, even if their stock prices seem high relative to their current earnings.the Beginners Guide to Stock Market Investing

7. Risks of Stock Market Investing For The Beginners Guide to Stock Market Investing

While investing in stocks can be profitable, there are risks:

- Market Risk: The risk that the entire market could decline, impacting your investments.

- Volatility Risk: The risk that stock prices could swing up and down rapidly.

- Liquidity Risk: The risk that you might not be able to sell your investment when you want.

- Company-Specific Risk: The risk that a company you invest in could face problems, leading to a decline in stock price.

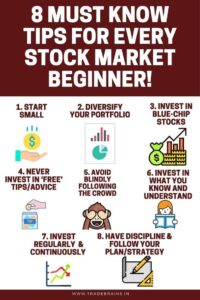

8. Tips for The Beginners Guide to Stock Market Investing

-

Start Small: Don’t invest more than you can afford to lose, especially when you’re just starting.

-

Stay Educated: Continuously learn about the stock market, economic indicators, and how companies operate.

-

Be Patient: Stock investing is a long-term endeavor. Avoid trying to time the market or make quick gains.

-

Have a Plan: Set clear investment goals and develop a strategy to achieve them.

-

Avoid Emotional Investing: Stay calm and avoid making impulsive decisions during market fluctuations.